The financial industry is experiencing a revolutionary transformation as digital solutions continue to replace traditional manual processes. Consumers and businesses today expect faster, simpler, and more secure financial services. From automated accounting to AI-powered investment platforms, digital wallets, and real-time payment processing, the need for intelligent financial operations has never been greater. To meet these demands, organizations must invest in advanced fintech applications that optimize workflows, enhance security, and deliver powerful user experiences.

Building such innovative solutions requires deep expertise in financial technology, data security, and regulatory compliance. Partnering with an experienced fintech app development company ensures that financial software is built using technologies such as AI, blockchain, machine learning, cloud computing, and automation — enabling businesses to achieve efficiency while staying competitive in a rapidly evolving digital landscape.

The Importance of Intelligent Financial Operations in Modern Businesses

As the volume of digital financial transactions increases globally, businesses face challenges such as fraud detection, high operational costs, compliance requirements, and customer expectations for instant responses. Intelligent financial operations help companies overcome these barriers by integrating advanced automated systems that streamline tasks and enhance data-driven decision-making.

Key reasons businesses are shifting to intelligent finance:

Reduced manual errors and operational delays

Enhanced financial transparency and reporting

Smart risk assessment and fraud monitoring

Automated workflow management

Real-time performance analytics

Improved customer service productivity

Lower operational expenditure and improved ROI

With advanced fintech solutions, companies can modernize outdated financial systems and deliver services that align with the rapidly changing digital era.

Core Elements of a Smart Fintech Solution

A powerful fintech platform must include technologies and features that support intelligent operations. Successful digital finance apps typically include:

1. Real-Time Transaction Processing

Instant payment processing ensures business continuity and customer satisfaction.

2. Automated Workflows and Financial Data Management

Automation minimizes manual work and human error.

3. Predictive Analytics & Performance Tracking

Businesses gain deeper insights into market behavior and customer activity.

4. AI-Based Fraud Detection and Risk Prevention

AI algorithms can analyze transaction patterns and detect anomalies instantly.

5. Omnichannel Payment Support

UPI, cards, bank transfers, QR, POS, digital wallets, and more.

6. Strong Regulatory Compliance

Adhering to laws such as PCI-DSS, KYC, AML, GDPR, and RBI guidelines.

7. Secure Cloud & API Integrations

Ensures seamless operations and scalability.

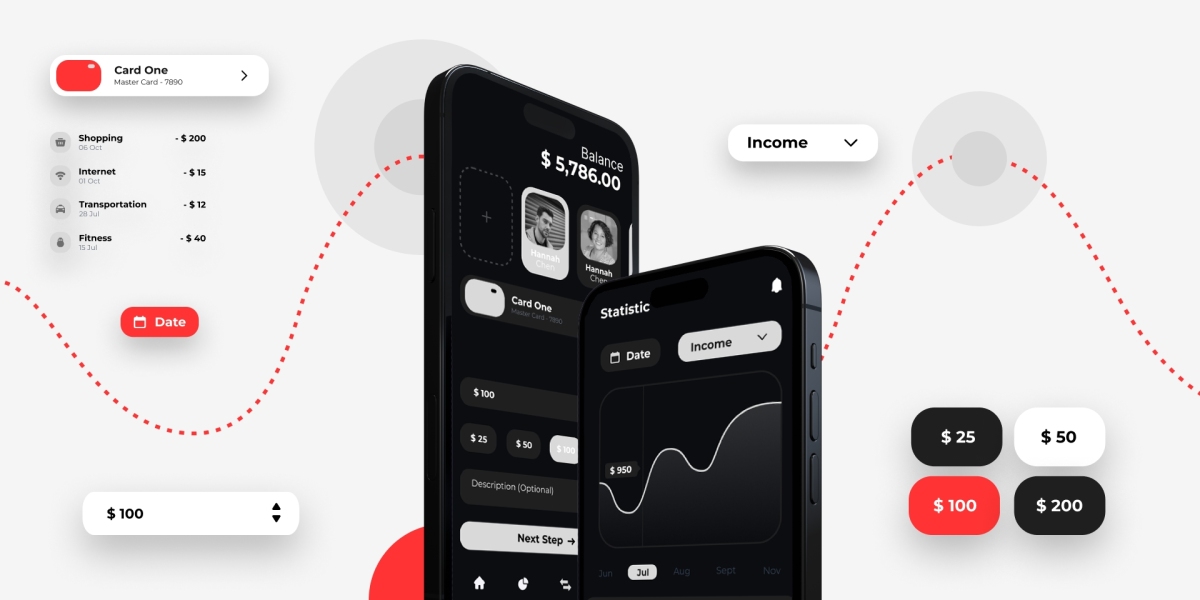

8. Intuitive and User-Friendly UI/UX

A smooth interface offers better experience, which builds trust and loyalty.

Intelligent Fintech Solutions Across Industries

Fintech transformation supports a wide range of industries and financial service providers, empowering them to modernize operations and deliver intelligent services. Popular application categories include:

Mobile Banking & Digital Banking Platforms

Digital Wallet & Payment Apps

Real-Time Fund Transfer & UPI Solutions

Personal Finance & Budgeting Applications

Lending & Microfinance Platforms

Investment, Trading & Wealth Management Apps

Cryptocurrency Exchange & Blockchain Wallet Systems

Insurance & InsurTech Platforms

POS & Merchant Payment Systems

Robo-Advisory Algorithms

These digital solutions enable businesses to handle large-scale transactions securely and efficiently.

Benefits of Intelligent Fintech App Development

Implementing intelligent financial operations offers significant advantages:

Instant digital processing with reduced workload

Borderless global transactions and multi-currency support

Automated customer service with chatbots & AI

Secure transactions with advanced encryption & biometric authentication

Real-time financial performance insights

Faster settlement and reconciliation processes

Reduced financial fraud risks

Improved compliance management and reporting accuracy

Enhanced customer experience and satisfaction

Long-term cost savings and operational scalability

By using advanced automation and secure architecture, businesses can optimize financial performance and accelerate growth.

Technologies Powering Intelligent Fintech Solutions

Modern fintech is driven by next-generation technologies that improve accuracy, performance, and decision-making:

Technology | Role in Intelligent Financial Operations |

Artificial Intelligence & Machine Learning | Risk scoring, fraud detection, chatbot support |

Blockchain | Secure payments, decentralized ledgers, smart contracts |

Cloud Computing | Scalable storage and global access |

IoT Integration | Smart POS & wearable payments |

Big Data & Analytics | Real-time market predictions |

Robotic Process Automation | Automated data processing |

Biometric Authentication | Increased transaction security |

Combining these technologies ensures reliability, high performance, and future scalability.

Why Choose Expert Fintech Developers?

Building intelligent financial software requires an expert team with deep industry knowledge, security experience, and technology specialization. Partnering with an expert provider ensures strategic development, risk reduction, and faster time to market.

Working with professional fintech app development services offers important advantages:

Complete end-to-end development: UI/UX, backend, security, and deployment

Tailor-made fintech architecture based on business needs

Advanced security frameworks and compliance integration

Experienced team for complex financial operations

Transparent development process & agile methodology

Post-launch support, maintenance, and performance upgrades

Choosing the right development partner ensures a high-performing fintech application built for long-term success.

Our Fintech Application Development Process

To deliver high-quality, secure, and scalable financial solutions, the development process includes:

Business requirement research & strategy planning

Competitor analysis and solution consultation

UX/UI wireframing and prototype design

Technical architecture and backend development

API & third-party integration

Intelligent automation & AI-based modules

Security & compliance implementation

Extensive QA testing and performance validation

Deployment on platforms such as web, Android & iOS

Maintenance, monitoring, and feature upgrades

Why Choose a Professional Fintech Application Development Company

Partnering with a reliable fintech application development company provides access to experienced fintech specialists, advanced technology tools, and proven financial infrastructure planning. It ensures secure development, optimized performance, and guaranteed compliance.

Key strengths of expert fintech developers:

Proven portfolio in intelligent financial operations

Solution-driven approach for complex financial workflows

High-performance architecture for enterprise applications

Regulatory guidance and privacy standards

Modern design and user-centric development practices

Scalable solutions to support future growth

Conclusion

Intelligent financial operations are reshaping the modern financial ecosystem, driving businesses toward automation, security, transparency, and improved user engagement. To thrive in the future, businesses must adopt fintech solutions that offer AI-driven intelligence, real-time data processing, and powerful security infrastructure. By collaborating with the right fintech experts, organizations can build reliable, scalable financial platforms and deliver world-class digital experiences.

Investing in intelligent fintech development is not just a step forward — it is the foundation of a future-ready business transformation.

Frequently Asked Questions (FAQs)

1. What is intelligent fintech app development?

Intelligent fintech development uses advanced technologies like AI, machine learning, blockchain, and automation to build financial applications that enable real-time, secure, and automated financial operations.

2. How does AI improve digital financial services?

AI improves risk management, fraud detection, customer personalization, credit scoring, transaction monitoring, and decision-making accuracy.

3. How long does it take to build a fintech application?

Development time averages between 3 to 6 months depending on features, technology, security, and integration requirements.

4. What features are essential in an intelligent fintech application?

Key features include automation, AI analytics, biometric security, real-time payments, blockchain systems, and regulatory compliance.

5. Do you provide support and future upgrades?

Yes, continuous updates, technical support, performance optimization, and security upgrades are available.

6. How secure are fintech applications?

Fintech apps include multi-layer encryption, biometric authentication, secure APIs, PCI-DSS compliance, and advanced fraud prevention technologies.